What Cca Class Is Construction Equipment . capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. class 8 (20%): buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. capital cost allowance (cca) replaces accounting depreciation for income tax purposes. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. 10 rows you can find a great cca list (by item and by class) in the fitac by first going to “tax rates and tools” and then “capital. what is capital cost allowance (cca)? Class 8 is dedicated to assets and equipment purchased for your. Various company assets and equipment.

from dxovuovpd.blob.core.windows.net

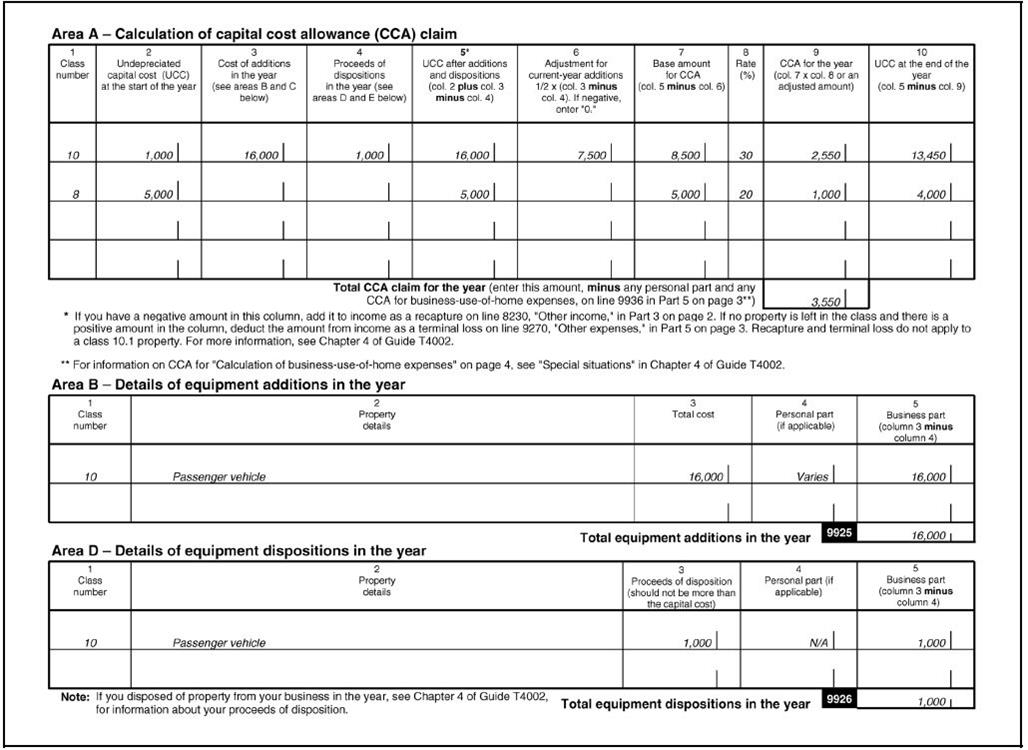

capital cost allowance (cca) replaces accounting depreciation for income tax purposes. 10 rows you can find a great cca list (by item and by class) in the fitac by first going to “tax rates and tools” and then “capital. class 8 (20%): Various company assets and equipment. Class 8 is dedicated to assets and equipment purchased for your. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. what is capital cost allowance (cca)? capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land.

What Cca Class Is Camera Equipment at Paul James blog

What Cca Class Is Construction Equipment capital cost allowance (cca) replaces accounting depreciation for income tax purposes. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. class 8 (20%): capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. Class 8 is dedicated to assets and equipment purchased for your. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. 10 rows you can find a great cca list (by item and by class) in the fitac by first going to “tax rates and tools” and then “capital. what is capital cost allowance (cca)? capital cost allowance (cca) replaces accounting depreciation for income tax purposes. Various company assets and equipment.

From www.made-in-china.com

CCA /CCS Equipment China Cca Equipment and Cladding Machine What Cca Class Is Construction Equipment capital cost allowance (cca) replaces accounting depreciation for income tax purposes. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. what is capital cost allowance (cca)? Various. What Cca Class Is Construction Equipment.

From ogca.ca

CCA 26 [Electronic Version] Guide to Construction Management project What Cca Class Is Construction Equipment what is capital cost allowance (cca)? capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. Class 8 is dedicated to assets and equipment purchased for your. class 8 (20%): to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies. What Cca Class Is Construction Equipment.

From www.nsw.navy.mil

First in History Special Boat Team 20 Receives Inaugural Battle “E What Cca Class Is Construction Equipment capital cost allowance (cca) replaces accounting depreciation for income tax purposes. Various company assets and equipment. Class 8 is dedicated to assets and equipment purchased for your. what is capital cost allowance (cca)? class 8 (20%): to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. 10 rows you. What Cca Class Is Construction Equipment.

From www.reddit.com

SWCC's aboard Combatant Craft Assault (CCA) fast boats conducting small What Cca Class Is Construction Equipment what is capital cost allowance (cca)? capital cost allowance (cca) replaces accounting depreciation for income tax purposes. Various company assets and equipment. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed. What Cca Class Is Construction Equipment.

From dxogzmqkf.blob.core.windows.net

Computer Hardware And Software Cca Class at Sarah Brown blog What Cca Class Is Construction Equipment buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. Various company assets and equipment. capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. class 8 (20%): capital cost allowance (cca) replaces. What Cca Class Is Construction Equipment.

From www.scribd.com

CCA Driveways PDF Road Surface Concrete What Cca Class Is Construction Equipment capital cost allowance (cca) replaces accounting depreciation for income tax purposes. class 8 (20%): Class 8 is dedicated to assets and equipment purchased for your. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. to calculate capital cost allowance (cca) on your depreciable. What Cca Class Is Construction Equipment.

From community.fccsoftware.ca

Setup FCC AgExpert Community What Cca Class Is Construction Equipment Various company assets and equipment. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. capital cost allowance (cca) replaces accounting depreciation for income tax purposes. capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets,. What Cca Class Is Construction Equipment.

From www.chegg.com

Solved Maple Enterprises Ltd. has always claimed maximum What Cca Class Is Construction Equipment class 8 (20%): capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. Class 8 is dedicated to assets and equipment purchased for your. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. Various company assets and equipment. . What Cca Class Is Construction Equipment.

From rctruckstop.com

What CCA Class Is a Pickup Truck? RCTruckStop What Cca Class Is Construction Equipment what is capital cost allowance (cca)? class 8 (20%): Various company assets and equipment. 10 rows you can find a great cca list (by item and by class) in the fitac by first going to “tax rates and tools” and then “capital. to calculate capital cost allowance (cca) on your depreciable properties, use the form that. What Cca Class Is Construction Equipment.

From community.fccsoftware.ca

Setup FCC AgExpert Community What Cca Class Is Construction Equipment Class 8 is dedicated to assets and equipment purchased for your. Various company assets and equipment. capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. class 8 (20%): to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. . What Cca Class Is Construction Equipment.

From www.studocu.com

2022 CCA Print Acct 4280 Common CCA Classes for 2022 AccII Effective What Cca Class Is Construction Equipment to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. what is capital cost allowance (cca)? 10 rows you can find a great cca list (by item and. What Cca Class Is Construction Equipment.

From www.studocu.com

CCA Classes CCA CLASSES CLASS 1 Buildings acquired AFTER 1987 What Cca Class Is Construction Equipment 10 rows you can find a great cca list (by item and by class) in the fitac by first going to “tax rates and tools” and then “capital. what is capital cost allowance (cca)? Class 8 is dedicated to assets and equipment purchased for your. capital cost allowance (cca) replaces accounting depreciation for income tax purposes. . What Cca Class Is Construction Equipment.

From dxovuovpd.blob.core.windows.net

What Cca Class Is Camera Equipment at Paul James blog What Cca Class Is Construction Equipment Various company assets and equipment. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. what is capital cost allowance (cca)? buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. capital cost allowance (cca) replaces accounting depreciation. What Cca Class Is Construction Equipment.

From dxovuovpd.blob.core.windows.net

What Cca Class Is Camera Equipment at Paul James blog What Cca Class Is Construction Equipment capital cost allowance (cca) replaces accounting depreciation for income tax purposes. what is capital cost allowance (cca)? Various company assets and equipment. class 8 (20%): to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. Class 8 is dedicated to assets and equipment purchased for your. capital cost allowance. What Cca Class Is Construction Equipment.

From dxovuovpd.blob.core.windows.net

What Cca Class Is Camera Equipment at Paul James blog What Cca Class Is Construction Equipment what is capital cost allowance (cca)? capital cost allowance (cca) replaces accounting depreciation for income tax purposes. to calculate capital cost allowance (cca) on your depreciable properties, use the form that applies to. Various company assets and equipment. class 8 (20%): buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall. What Cca Class Is Construction Equipment.

From www.koppersperformancechemicals.com

Koppers CCA Treated Wood Proucts What Cca Class Is Construction Equipment buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. Class 8 is dedicated to assets and equipment purchased for your. Various company assets and equipment. 10 rows you can find a great cca list (by item and by class) in the fitac by first going. What Cca Class Is Construction Equipment.

From www.chegg.com

Solved Assignment Problem Five 2 (CCA Calculations) On What Cca Class Is Construction Equipment what is capital cost allowance (cca)? buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. capital cost allowance (cca) is the depreciation that is allowed to be expensed for tax purposes for fixed assets, except land. Class 8 is dedicated to assets and equipment. What Cca Class Is Construction Equipment.

From www.heavyequipmentguide.ca

CCA launches campaign to encourage new generation to join construction What Cca Class Is Construction Equipment Various company assets and equipment. buildings and their major components, such as electrical wiring, hvac systems, and elevators, fall into class one, which has a capital cost. capital cost allowance (cca) replaces accounting depreciation for income tax purposes. Class 8 is dedicated to assets and equipment purchased for your. to calculate capital cost allowance (cca) on your. What Cca Class Is Construction Equipment.